This has been a work in progress today as I do other things. This is the third graph I have done – each requires that I input data into Excel, draw a graph, scan the graph and load it into WordPress. I hope I am done with that.

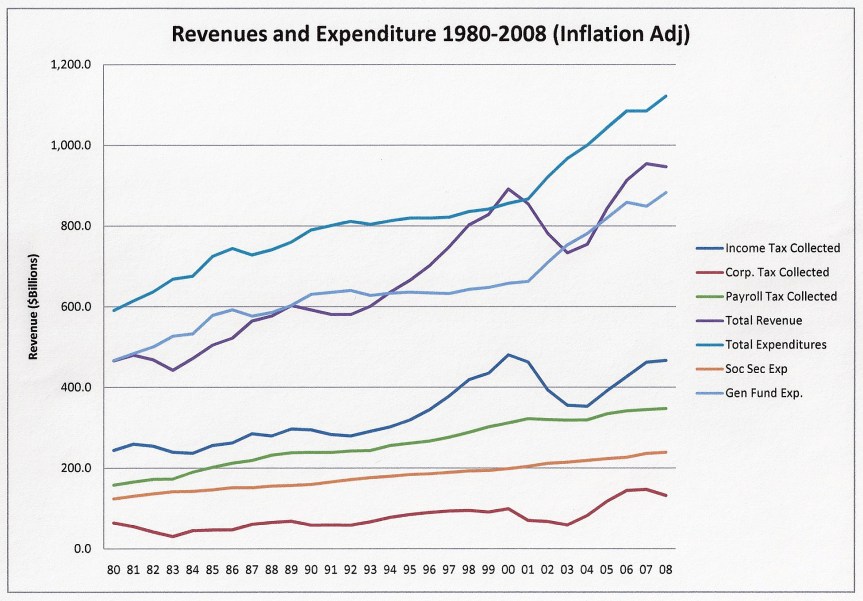

The lines are, top to bottom:

Total Federal Government Expenditures (Gay blue)

Total Revenue (Purple hue)

General Fund Expenditures (Navy Bluish hue)

Income Tax Collections (Dark Blue)

Payroll Tax Collections (Green)

Social Security Expenditures (Tan)

Corporate Tax Collections (Brown)

All are inflation-adjusted – 1980 = 100.

Conclusions:

1) The more lines, the harder to interpret, and the narrow space allotted by WordPress makes matters worse. The colors assigned by Excel are too close together in the blue range.

2) Total revenue (purple) has taken serious hits in the early 1980’s and early 2000’s, due to tax cuts. After taking those hits, it climbs back up to the same line it was on before the tax cuts took effect. In other words, we are on the left side of the Laffer Curve. Furthermore, tax cuts do not produce increased revenue. Never have. That’s Reaganist mythology.

3) Social Security revenues (green) and expenditures (tan) run a straight line. Revenues outpace expenditures consistently, though not so much as indicated on the chart, as “Payroll Tax” (green) also includes Medicare receipts.

4) Corporate revenues have been relatively flat – that sector is carrying less and less of the burden. The “corporate tax is paid by consumers” set has had their way, no matter popular opinion. Corporations have a lot of power, I might add.

5) At one time, in 1999, we ran a true surplus – it is that little purple point you see above the blue line around 1999. It means that revenue from all sources exceeded all expenditures. That was probably an accident, dot-com bubble and all that. Clinton didn’t plan it, I’m sure. It’s even perilous, as people begin to clamor for thing like health care and infrastructure spending when there is a surplus. That’s why the surplus was quickly undone in the 2000’s.

6) Income taxes shot up in the 1990’s, and this was after a tax increase during a recession. This confounds the right wing, as the tax hike should have had the opposite effect.

7) Dave Budge says “You can’t draw any conclusions from this. Too many variables. (He was commenting on an earlier version I put up, but still, I take that to mean that it did not demonstrate that he is correct in his economic outlook. Otherwise, it would be highly demonstrative of practical use of right wing economics.) As it is, it pretty much shows that right wing economics is the result of flat-earth thinking.

PS: Anyone who wants to play with this some more, let me know in the comments below and I will email the Excel file to you.

Here’s my conclusion. You can’t draw any conclusions from this. Too many variables. Now, if you had drawn the Total expenditure line you could that no where during that period did we have “surplus.” But, being the accountant you are you know you could see that simply in the national debt.

But, in the long run, it’s all irrelevant since deficit spending is noting but a differed tax.

LikeLike

When I get time, maybe this evening, I intend to add inflation-adjusted spending. And I agree that deficit spending is just another tax. Never doubted that.

My primary focus was to see if tax cuts promoted increased revenues. Plainly, they don’t. Every major tax cut produced a drop in revenue. Later, it climbs back up on the same line it was on before. With the Bush tax cuts, we are still not where we were in 2000.

Also, if you put a ruler on the income tax line, you can clearly see bubbles and recessions. I am very curious where we are this moment.

LikeLike

Mark, anyone who tells you that any tax cut will increase revenues is ignorant. As we’ve discussed, it depends where taxes are on the “Laffer” curve (actually the Laffer curve was discovered by a 13th century Persian – Laffer gets undue credit.)

But you have look a bit deeper. Since not all taxes are equal reductions in different taxes my show revenue increases where general cut in taxes won’t.

But sill I hold that there are too many other variables – as you mentioned – to really know.

One last thing. Since we include SoSec receipts in debt (net of payments) as a transfer to the Treasury don’t you think they should be taken out of revenue? (yes, I think you can blame either Nixon or Reagan for that) Look at what happens to the deficit then.

LikeLike

I agree. I believe the concept of “Unified Federal Budget” goes back to LBJ. It’s deliberately deceptive.

There is no evidence here that reduced taxes have increased revenues. Many have said that to me – too many to mention. It’s almost gospel that Reagan cut taxes and increased federal revenues.

But if it is even a little bit true, shouldn’t there be a little bit of evidence somewhere?

Best I’ve seen is the capital gains tax, but I’m not sure that CG revenues are not more sensitive to the market itself rather than the tax rate.

LikeLike

Mark, just a couple of things. First, the revenue declines of 80 – 83 were a recessionary effect. Secondly, and I’m not trying to prove it here, but the huge reductions in top marginal tax rates of the early ’80s at least didn’t a negative effect on total Income tax. So the question is; did the Reagan tax cuts go too far down the curve to have a significant increase in taxes. It’s a legitimate question. In other words, wouldn’t we expect tax revenues to decline sharply all things being equal after the tax cuts? They didn’t.

But like I said, there are far too many variables to know. It’s just like how I argue about Keynesian stimulus spending. There is no empirical proof that it’s actually stimulative. Yet economists use this stuff as if it were the gospel truth and politicians use it to expand government. Therefor, I think you your left/right paradigm is nonsense. Lefties tell us we have to engage in deficit spending for stimulus with as much religiosity as supply siders say tax cuts always increase revenues.

LikeLike

Just out of curiosity, since I know that the numbers are apples and oranges, but would it be possible to superimpose the GDP over the same period of time?

LikeLike

What would be more meaningful is to look at all of these as a % of GDP.

LikeLike

Mark, email the table and I’ll convert it to % of GDP.

LikeLike

Dave look here in Table 1.3: http://www.whitehouse.gov/omb/budget/fy2007/pdf/hist.pdf

LikeLike

… the revenue declines of 80 – 83 were a recessionary effect. Secondly, and I’m not trying to prove it here, but the huge reductions in top marginal tax rates of the early ’80s at least didn’t a negative effect on total Income tax. So the question is; did the Reagan tax cuts go too far down the curve to have a significant increase in taxes. It’s a legitimate question. In other words, wouldn’t we expect tax revenues to decline sharply all things being equal after the tax cuts? They didn’t.

I suspect it’s rather obfuscating to say that tax collections decreased due to a recession and not due to tax cuts when you cannot point to a time when tax cuts increased revenues. It leaves you without evidence, and married to theory. But I’ll concede the point, as in my mind, the 1980’s tax cuts should have increased revenue, and they didn’t.

The reason they should have increased: Only a damned fool actually paid 70% – it was manipulative, causing people to invest in munis and get ITC by buying hard equipment and make large charitable contributions and invest in oil wells with immediate huge write offs. So logically, one would think that there would be a positive effect on collections from dropping the top rate. But it doesn’t happen. I don’t know why.

But like I said, there are far too many variables to know. It’s just like how I argue about Keynesian stimulus spending. There is no empirical proof that it’s actually stimulative. Yet economists use this stuff as if it were the gospel truth and politicians use it to expand government. Therefor, I think you your left/right paradigm is nonsense. Lefties tell us we have to engage in deficit spending for stimulus with as much religiosity as supply siders say tax cuts always increase revenues.

I’m interested in how people behave in response to taxation. I don’t know that stimulation works, but I’m pretty sure that if we don’t have demand, we don’t have much else. But it’s all above my pay grade.

I do have an agenda – I do have certain beliefs. I see tax policy as a necessary remedy for the extremes brought about by market capitalism. I don’t beleive people are so different in talent that one man is worth a million or a billion times another. Time and chances doth happen to us all. It’s like the board game monopoly where early advantage feeds on itself and creates a force that eventually controls the whole board. Yes, that happens naturally. But do we have to let it happen? No.

Tax policy, the progressive tax, is sound social policy, and worked effectively for many years prior to 1980. I think we will go full circle again and come to realize this – that our forebears were not fools after all, and that there really hasn’t been that much “progress”. Things are pretty much as they have always been. And the world that Dickens described is always waiting for us if we let nature take its course.

This is where we differ.

LikeLike

Mark, why do you insist that every question is but obfuscation? It’s a legitimate question. Have you ever heard me argue that tax cuts are always a fiscal remedy? I’ve never made that argument.

So, if you’re really wondering then why do you paint that question as ideological? There is nothing ideological about it.

What it seems you’re trying to do if fit your hypothesis into a half-baked statical construct. Are you really interested in knowing or what?

LikeLike

We are debating past one another, that’s all. I’m dealing with the bulk of the conservative community, and you are saying you’re not part of it.

We differ ideologically in that I believe in progressive taxation, and you do to a much lesser extent – only becuase wealthy people get more tax benefits. I’m ideologically left of that.

That’s all that’s going on. But I did put forth my ideology. My economic cloak is off. I believe in progressive taxation, and I don’t much care about the revenue it raises.

But the numbers I collected are interesting. I did not expect some of what I got. Usually the case. I’m not looking for an ideological construct. I only set out to unearth the evidence around the conservative belief that tax cuts raise revenue.

LikeLike